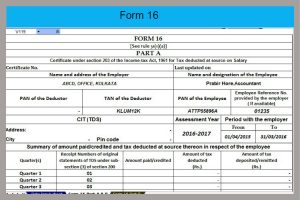

Form 16 Verification

Form 16 is undeniably one of the most important tax documents that salaried employees get. The form clearly states the gross salary that an individual drew in the past year, and can help businesses provide financial incentives and salaries on the basis of the employee’s past compensation. Form 16 verification allows the employer to verify the TDS deducted for a specified PAN (of the employee) against a specific TAN (of the employer).

Form 16 verification can hence ensure that the candidate’s past compensation details are authentic. Basis the credibility of the report, the next employer can provide suitable financial incentives.

Form 16 verification acts as a reliable proof for a person’s emoluments and name of his past employer. CAREER44 uses advanced APIs to verify Form 16 provided by an individual. Antecedents verified include:

Name of the person for the associated PAN

Past employers

TDS deducted

Form16 Verification

KYC Solution

OUR EXPERTISE